Other links (not endorsement)

Institute of

Transport and Logistics Studies (ITLS) - Sydney

University

Greaves, S.P., Ellison, A.B., Personality, risk aversion and speeding: An empirical investigation. Accid. Anal. Prev. (2011)

Devices to help drivers control their speed - Intelligent Speed Assistance (ISA)

inthinc Wins Best of State Award for Driving Safety System + inthinc Technology Used in Landmark IIHS Study on Teen Driving Safety

Pay How You Drive

insurance (UK)

Young drivers 'pay how you drive' insurance unveiled by Co-op

'Pay how you drive' car insurance brought in for teens

'Pay

how

you drive' insurance launched

Pay

As

You Drive car insurance around the world - SaraFreeKm

(SARA) – Italy’s PAYD uses a GPS device which relies on

satellite data to calculate the exact kilometres driven.

In-vehicle

driver

behaviour technology is a fundamental component [of

insurance]

TomTom

enters

insurance telematics market

Auto insurers in Europe may use black box technology to set rates

Betterdriver.com.au - AAMI has offered a 20% discount on car insurance for the first 1,000 customers who take up the BetterDriver™ Service (May 2012).

A National Strategy to Revolutionise Road Use - "The in-vehicle units would monitor each vehicles location, speed and acceleration using GPS, but they would send data to the central system only for safety, emergency, law enforcement and research..."

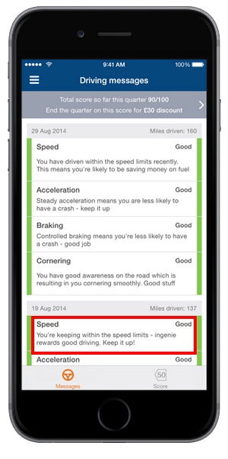

Ingenie - UK pay-how-you-drive insurance - "After a year with ingenie, on average the cost of our customers' insurance comes down by around 50% – that's an average of £800 cheaper." Ingenie won the 2013 Prince Michael Awards for Road Safety for Young Drivers

SKYEYE driving management system (Taiwan)

Traffic Injury Prevention: A

One Year Pay-as-You-Speed Trial With Economic Incentives for

Not Speeding - a PAYS concept is an effective way to

reduce speed violations. Hence, it has the possibility to

reduce crash severity and thereby to save lives. This could be

an important step toward a safer road transport system. The

majority of the participants were in favor of the concept,

which indicates the potential of a new insurance product in

the future.

2017: Insure-the-box UK system with with Accident Alert - The in-tele-box fitted to your car can sense a strong impact on the car. When this happens, an alarm is activated in our Service Centre. If your car is stationary, we will try to call you to check you are OK and try to help you get going. If your car is moving we will assume you do not require urgent assistance.If we can’t get in contact and your car is not moving we will assess all the circumstances relating to the incident. If appropriate, we will attempt to contact the emergency services.

2017 CIS: The Economics of road safety and insurance - discusses telematics and PHYD insurance

2018 QBE Insurance: How Insurance Box works - first Australian PHYD insurance product? Update Oct 18: QBE has withdrawn this product!

2018 Ubicar has

introduced a telematics safety product in Australia. Sydney's

Northern Beaches Council has a safe driving

competition for residents.(update 2023: No longer

available)

Created by Michael

Paine, March 2012